In the landscape of modern healthcare, early screenings serve as the cornerstone of preventive health. These proactive medical assessments allow individuals to detect diseases in their earliest stages, often before symptoms even appear. For many, access to such screenings—and the broader framework of preventive care—depends on a crucial element: health coverage. That is why medical insurance is important not only as a safeguard against catastrophic illness but as a vehicle for long-term wellness. It enables individuals to engage with healthcare systems regularly, thus improving outcomes and reducing costs in the long run.

You may also like: The Vital Health Benefits of Preventive Medicine: Why Early Detection Matters More Than Ever

Understanding Preventive Health: The Science of Staying Ahead

Preventive health is a holistic approach to healthcare that emphasizes the early detection and prevention of disease rather than reactive treatment. It encompasses a variety of services, including routine physical exams, immunizations, blood pressure monitoring, cholesterol checks, cancer screenings, and lifestyle counseling. These services, often bundled into wellness programs, are designed to intercept health issues before they evolve into complex, high-cost conditions. The strategy is rooted in epidemiological studies that show early interventions can dramatically reduce morbidity and mortality rates.

Consider, for instance, the case of colorectal cancer. When caught in its early stages through routine screenings such as colonoscopies, this cancer has a five-year survival rate of over 90%. Without early detection, however, survival rates plummet, and treatment becomes more invasive and expensive. Similarly, conditions like hypertension and Type 2 diabetes can be managed effectively if detected early, often through simple annual check-ups covered by insurance. These examples underscore how preventive health, supported by consistent access to care, creates a virtuous cycle of wellness.

Why Medical Insurance Is Important in Facilitating Preventive Health

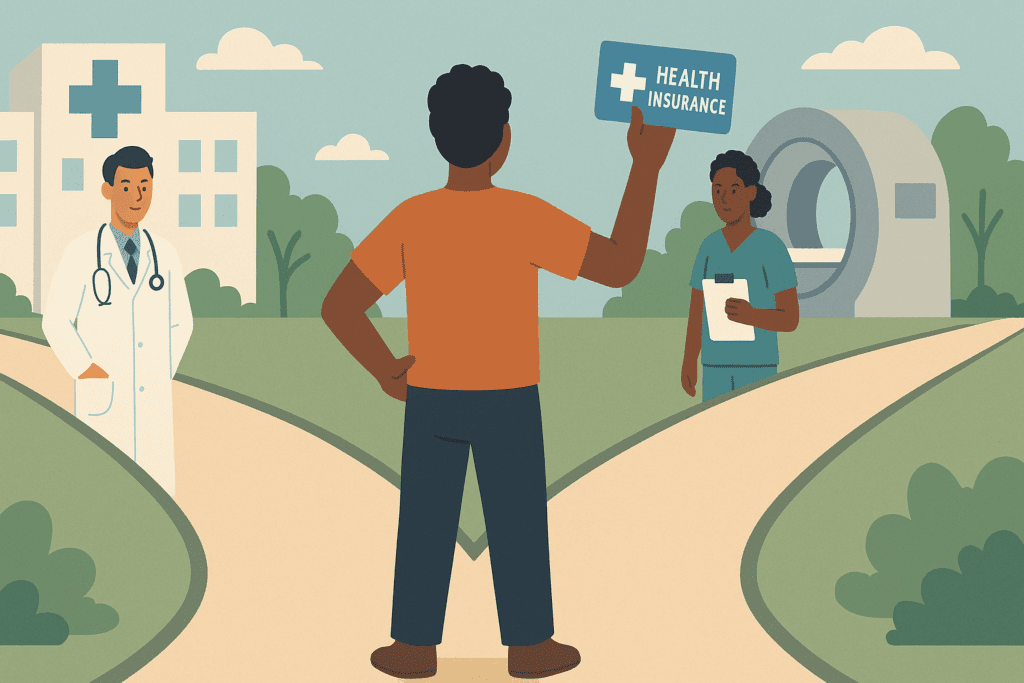

The presence or absence of medical insurance significantly determines whether individuals can access preventive health services. Without insurance, routine screenings and wellness visits can be prohibitively expensive, especially for lower-income populations. Even minor procedures can carry costs that deter people from seeking timely care. Medical insurance breaks down these financial barriers, offering a structured means to obtain essential screenings at little to no out-of-pocket cost.

Moreover, insured individuals are more likely to establish long-term relationships with primary care providers, which encourages continuity of care. This continuity is essential for building trust, identifying risk factors, and creating personalized health plans. Health insurance plans typically include a comprehensive list of covered preventive services, such as mammograms, Pap smears, and lipid panels, all of which are essential for early detection. The broader the coverage, the greater the scope for identifying health threats before they escalate. This accessibility is among the top advantages of health insurance, linking fiscal protection with improved health outcomes.

How Early Screenings Reduce Healthcare Costs

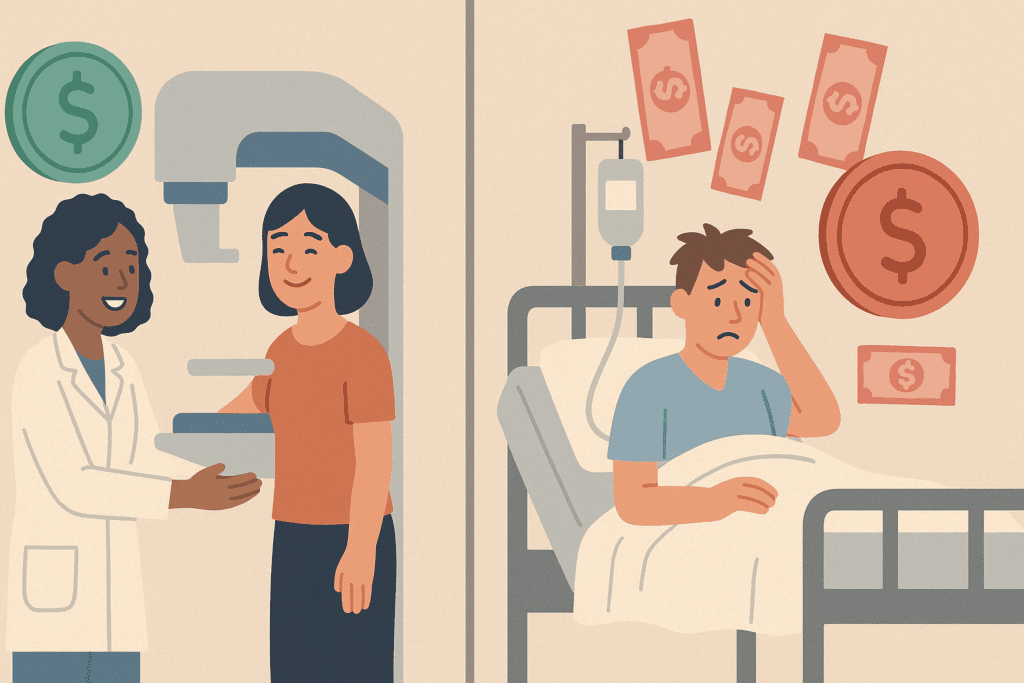

One of the most compelling arguments for early screenings lies in their capacity to reduce long-term healthcare costs. While screenings do involve upfront expenditures, they often prevent far more expensive treatments later. For instance, the cost of managing late-stage cancer is exponentially higher than diagnosing and treating a tumor in its initial phase. According to the CDC, for every dollar spent on preventive care, several dollars are saved in future medical expenses.

From an economic standpoint, medical insurance companies also benefit from promoting early screenings. Lower costs per patient equate to better actuarial outcomes, which in turn allows insurers to maintain more sustainable risk pools. Encouraging preventive care through comprehensive insurance plans thus becomes a financially sound strategy for all parties involved. This economic incentive contributes to the increasing emphasis on value-based care, which rewards outcomes rather than volume of services. Here again, we see why medical insurance is important: it creates a framework for cost-efficient, patient-centered care.

Access and Equity: Bridging Gaps Through Insurance

Despite advances in healthcare access, disparities persist along socioeconomic, racial, and geographic lines. These disparities often manifest in preventable diseases going undiagnosed in underserved populations. One of the key ways to bridge this gap is through comprehensive medical insurance coverage. Insurance provides a pathway for marginalized communities to receive routine screenings that they might otherwise forgo due to cost or lack of access.

Studies have shown that individuals with insurance are more likely to receive age-appropriate screenings for diseases like breast cancer, cervical cancer, and hypertension. In communities where public insurance programs like Medicaid are robust, early detection rates improve significantly. Conversely, uninsured populations suffer from delayed diagnoses and higher rates of advanced disease at the time of first treatment. Health insurance serves not only as a fiscal safety net but also as a tool for health equity. By ensuring that preventive services are available to all, insurance systems can help eliminate one of the most persistent forms of healthcare inequality.

Policy Implications: Legislative Support for Preventive Care

The role of government policy in promoting preventive health cannot be overstated. Legislation such as the Affordable Care Act (ACA) mandates coverage of a suite of preventive services without co-pays or deductibles. These include cancer screenings, immunizations, and chronic disease assessments. By embedding preventive care into the structure of mandatory insurance plans, the ACA acknowledges why medical insurance is important—not merely as a shield against catastrophic costs but as a facilitator of early, life-saving interventions.

In addition, policy frameworks that support Medicaid expansion, subsidized health plans, and community health initiatives amplify the reach of early screenings. Public-private partnerships, grants for preventive care research, and employer-sponsored wellness programs all contribute to an ecosystem where prevention is prioritized. These legislative and institutional efforts reinforce the message that preventive care is not a luxury but a foundational element of a healthy society.

The Psychological Impact of Coverage on Health Behavior

Beyond financial access, medical insurance also plays a psychological role in how individuals engage with their health. Knowing that screenings are covered can reduce anxiety about costs and encourage proactive behavior. This phenomenon, often referred to as “coverage confidence,” leads to higher rates of health-seeking actions among insured individuals. They are more likely to schedule annual check-ups, follow through with diagnostic tests, and adhere to medical advice.

Moreover, insurance coverage can mitigate the fear associated with potential diagnoses. When individuals are uninsured, they may avoid screenings out of fear that they won’t be able to afford subsequent treatment if something is found. This delay can lead to worse outcomes and more intensive interventions. By alleviating these fears, insurance empowers individuals to take control of their health journey. This empowerment reinforces why medical insurance is important in cultivating not just physical well-being, but mental resilience and agency.

Workplace Wellness and the Role of Employer-Sponsored Plans

Employers have increasingly embraced their role in fostering preventive health through insurance. Employer-sponsored health plans often include incentives for completing annual physicals, biometric screenings, and health risk assessments. These plans may offer reduced premiums, wellness stipends, or other benefits to encourage participation in preventive programs. This alignment of workplace culture with personal health initiatives creates a powerful feedback loop.

Such programs have been shown to reduce absenteeism, improve productivity, and boost employee morale. When workers know that their insurance covers preventive care, they are more likely to engage in healthy behaviors. Employers, in turn, benefit from a healthier workforce with fewer days lost to preventable illnesses. This synergy illustrates another of the many advantages of health insurance—its capacity to harmonize individual and organizational health goals.

Health Literacy and Navigating Preventive Services

Even with insurance, navigating the complexities of preventive care can be daunting. Health literacy plays a crucial role in determining how well individuals can understand, access, and act upon preventive services. Insurers and healthcare providers must therefore invest in educational campaigns that clearly explain which screenings are available, how often they should be undertaken, and what the results mean.

Digital portals, nurse hotlines, and multilingual outreach materials are examples of tools that can enhance health literacy. When people understand the purpose and process of early screenings, they are more likely to participate. Health insurance companies that proactively support these educational efforts create a more informed customer base, which in turn leads to better health outcomes. Clarity and transparency in coverage further enhance trust and utilization rates, reinforcing the strategic importance of insurance in public health.

Preventive Health Across the Lifespan

Preventive health is not a one-size-fits-all endeavor; it evolves with age and life stage. Pediatric preventive care includes vaccinations, developmental screenings, and nutritional guidance, all typically covered under family insurance plans. As individuals age, the focus shifts to reproductive health, mental wellness assessments, and chronic disease screening. In later years, preventive care targets cognitive decline, bone density, and cardiovascular risks.

Medical insurance provides the continuity necessary to manage these shifting needs. Without insurance, people often delay or forgo care during critical transitions, such as adolescence to adulthood or into senior years. This interruption can allow preventable conditions to take root and progress. A lifetime of consistent, insured preventive care offers the best chance for maintaining health, reducing hospitalizations, and achieving quality of life across all stages. This cradle-to-grave benefit profile underscores why medical insurance is important not just episodically but as a sustained investment in well-being.

Global Perspectives on Preventive Care and Insurance Models

The importance of insurance in preventive care is recognized globally, though the models vary. Countries with universal healthcare systems, such as the UK, Canada, and Sweden, integrate preventive screenings into publicly funded services. These systems often achieve high screening rates because there are minimal financial or logistical barriers. In contrast, countries with more fragmented insurance markets, like the United States, face challenges in consistency and access.

However, innovative insurance models around the world offer valuable lessons. For example, Japan emphasizes annual health check-ups as a social norm, supported by both employers and the government. Germany’s statutory health insurance mandates coverage for a comprehensive set of preventive services. In each case, the interplay between policy, culture, and insurance infrastructure determines how effectively early screenings are utilized. Examining these models reveals common threads: accessibility, affordability, and awareness. These are the pillars upon which effective preventive care rests, and they all trace back to robust insurance mechanisms.

Digital Health Technologies and the Evolution of Screening

The rise of digital health has expanded the landscape of preventive care. Wearable devices, telemedicine, and at-home testing kits offer new modalities for early detection. These tools can monitor heart rate variability, glucose levels, sleep patterns, and even mental health indicators in real time. Integrating these technologies into insurance-covered care pathways enables a more responsive and personalized approach to health.

Insurance companies are beginning to recognize the value of these tools and incorporate them into wellness incentives. For example, policyholders may receive premium discounts for using fitness trackers or participating in telehealth screenings. Such initiatives lower the threshold for preventive engagement, especially for individuals in remote or underserved areas. By supporting these technological advancements, insurance providers modernize the delivery of early screenings, making them more accessible and user-friendly. This evolution enhances the advantages of health insurance, aligning cutting-edge innovation with public health goals.

A Closer Look at Cost-Effectiveness and ROI

Preventive care yields a strong return on investment (ROI), both for individuals and insurers. A study by the Robert Wood Johnson Foundation found that investments in community-based prevention could return over five dollars for every one dollar spent within five years. This ROI is not limited to economic factors; it includes improved quality of life, increased productivity, and reduced caregiver burden.

Medical insurance plays a pivotal role in realizing this ROI by ensuring that preventive services are widely utilized. When insurers cover screenings, they reduce the incidence of emergency room visits, hospitalizations, and chronic disease complications. Over time, this translates into lower premiums, improved public health statistics, and a healthier society. These cascading benefits demonstrate not just why medical insurance is important, but why it is indispensable in any sustainable healthcare model.

Frequently Asked Questions: The Long-Term Value of Preventive Screenings and Insurance Coverage

How does medical insurance support individuals with chronic illnesses in managing their preventive care needs?

Medical insurance provides a critical structure for individuals with chronic conditions to manage their health proactively. It often includes coverage for frequent monitoring, lab tests, and check-ins with specialists—services that are essential for adjusting treatment plans and preventing complications. For instance, a person with diabetes may need quarterly A1C tests and annual eye exams to prevent long-term damage, all of which are typically covered under comprehensive insurance plans. Without coverage, these preventive touchpoints might be delayed or skipped, leading to avoidable hospitalizations or disease progression. The advantages of health insurance in this context go beyond cost savings—they provide continuity, reduce emotional burden, and foster accountability in managing lifelong health conditions.

What are some emerging technologies in early screenings, and how does insurance play a role in access to these innovations?

Emerging technologies such as AI-powered diagnostics, genetic screening panels, and home-based health monitoring devices are rapidly transforming preventive care. These tools can detect subtle health indicators with unprecedented precision, allowing for earlier intervention than traditional methods. However, access to such technologies is often limited by high costs. Medical insurance providers that integrate these tools into their covered benefits enable broader participation and adoption. As these innovations become mainstream, understanding why medical insurance is important includes recognizing its role in democratizing access to cutting-edge preventive strategies.

How does health insurance impact the timing and frequency of preventive screenings?

The timing and frequency of screenings are vital factors in their effectiveness. Medical insurance helps establish routine by aligning preventive services with recommended care schedules—such as annual mammograms for women over 40 or cholesterol checks every five years for adults over 20. These guidelines are often embedded within insurance policies, and reminders may be sent to patients to prompt timely action. This systematic approach reduces gaps in care and improves adherence to public health recommendations. One of the overlooked advantages of health insurance is its role in operationalizing these standards, making timely care less dependent on memory or personal motivation alone.

What are the social implications of widespread preventive care access through insurance?

When large populations have insurance that covers preventive care, the broader social benefits extend beyond individual health. Community-wide screening initiatives can help reduce disease prevalence, ease pressure on emergency departments, and improve productivity in workplaces. These ripple effects contribute to stronger public health infrastructure and can even reduce health disparities over time. Moreover, preventive insurance coverage empowers individuals to become more engaged with their well-being, fostering a culture of health literacy. This is another lens through which to view why medical insurance is important—not only as a personal asset, but as a catalyst for social change.

In what ways does insurance affect mental health screenings and support?

Mental health often goes undiagnosed due to stigma or lack of coverage, but insurance is changing that narrative. Many plans now cover routine mental health screenings during primary care visits, making it easier to identify issues like anxiety, depression, or substance misuse early. Once identified, individuals can access therapy, medication, or counseling programs with reduced financial burden. Early mental health intervention leads to better outcomes and less disruption in work and relationships. The advantages of health insurance here include both practical coverage and the normalization of seeking help, a major step in tackling the global mental health crisis.

Why medical insurance is important for sustaining preventive care across generations

Intergenerational wellness is increasingly tied to how consistently families access preventive care, and medical insurance plays a pivotal role in this continuity. Parents with coverage are more likely to ensure their children receive timely vaccinations, developmental assessments, and dental check-ups. Likewise, insured adults are better prepared to manage age-related conditions that might otherwise strain family resources later. Over time, this creates a familial norm where health maintenance is routine rather than reactive. Recognizing why medical insurance is important includes seeing its role in building preventive habits that can be passed from one generation to the next.

How does medical insurance influence patient-provider relationships in preventive health?

Long-term relationships with trusted providers are essential for personalized preventive care, and insurance greatly facilitates this continuity. Patients who are insured are more likely to maintain regular appointments with the same physicians, enabling nuanced tracking of changes in health status. These providers can tailor screening recommendations based on family history, occupational risks, or lifestyle factors. Insurance coverage also enables follow-up care that might otherwise be deferred due to cost, reinforcing the relationship further. This personalized care model is one of the understated advantages of health insurance, fostering deeper trust and better outcomes through familiarity and consistency.

Why medical insurance is important when planning for life transitions and health milestones

Health milestones—like adolescence, pregnancy, and retirement—come with specific screening and preventive needs. Medical insurance helps individuals navigate these transitions by covering targeted services such as prenatal visits, mammograms, or bone density scans. For young adults transitioning off their parents’ plans, having access to preventive care through college or workplace coverage can maintain the momentum of lifelong wellness. Likewise, retirees benefit from screenings that help manage chronic conditions before they lead to hospitalization. These stages of life highlight why medical insurance is important as a stabilizing factor during periods of physiological and lifestyle change.

What role does employer-sponsored insurance play in expanding preventive care access?

Employer-sponsored insurance is one of the most effective vehicles for widespread access to preventive services. Companies often negotiate broad coverage that includes wellness perks like biometric screenings, health risk assessments, and tobacco cessation programs. Employees with such plans are more likely to complete their annual check-ups, which allows for early detection of issues that could reduce productivity or lead to long-term disability. The business case is strong: healthier employees lead to lower absenteeism and fewer claims. Therefore, one of the often-cited advantages of health insurance through employers is its dual role in safeguarding both workforce vitality and financial sustainability.

Can medical insurance reduce healthcare-related anxiety and improve decision-making confidence?

Absolutely. One underexplored benefit of medical insurance is its psychological reassurance. When people know they can afford screenings or specialist consultations without financial distress, they’re more likely to make timely health decisions. This confidence reduces stress during medical uncertainty and empowers people to engage proactively with their health. It also curbs the tendency to avoid care due to fear of unaffordable bills. As healthcare decisions grow increasingly complex, having a safety net enhances mental clarity, helping individuals weigh options with less emotional friction. This emotional security adds another dimension to why medical insurance is important in today’s high-stakes healthcare environment.

Conclusion: Investing in Prevention for a Healthier Future

In a world where chronic diseases are on the rise and healthcare costs are escalating, preventive health is more essential than ever. Early screenings, facilitated through comprehensive medical insurance, provide a pathway to timely diagnosis, effective treatment, and improved quality of life. They serve as the frontline defense against a host of preventable conditions, from cancer to cardiovascular disease.

This is why medical insurance is important—not merely as a financial buffer, but as a vital enabler of health equity, behavioral change, and systemic efficiency. It connects individuals to a continuum of care that supports wellness at every stage of life. The advantages of health insurance are manifold, extending far beyond coverage of emergencies to encompass proactive, personalized, and preventive services.

As we look toward the future, the integration of policy, technology, and education will be crucial in enhancing the effectiveness of early screenings. But at the foundation of this advancement lies access. Ensuring that everyone has the medical insurance they need to pursue preventive health will shape not only individual outcomes but the collective well-being of our society. In that sense, the choice to prioritize early screenings and health coverage is not just wise—it is transformative.

Further Reading:

Why is health insurance important?